https://digital.hbs.edu/platform-rctom/submission/accorhotels-battling-against-online-travel-agents/

AccorHotels: Battling against Online Travel Agents

"There are many new participants in the value chain and every one of them is trying to eat some of the cake" — Sebastien Bazin, CEO of Accor Hotels (2)

Digital technology is changing the hospitality industry

With the advent of digital technologies, global hotel management companies face increasing competitions in every step of the value chain. At every customer touch point, digital technology has allowed various companies to enter the value chain, disrupting the entire hospitality industry and undermining major value propositions that traditional hotel management companies offer. In order to maintain their market shares in this highly competitive industry, hotel management companies were forced to redefine their digital strategies.

AccorHotels has taken the lead in aggressively reshaping its business models in order to effectively compete with many new entrants that threaten its profitability. A leading French hotel operator with portfolio of brands spanning across different segments, Accor has 3,942 hotels or 524,955 rooms around the world as of June 2016 (1).

Redefining customer experience:

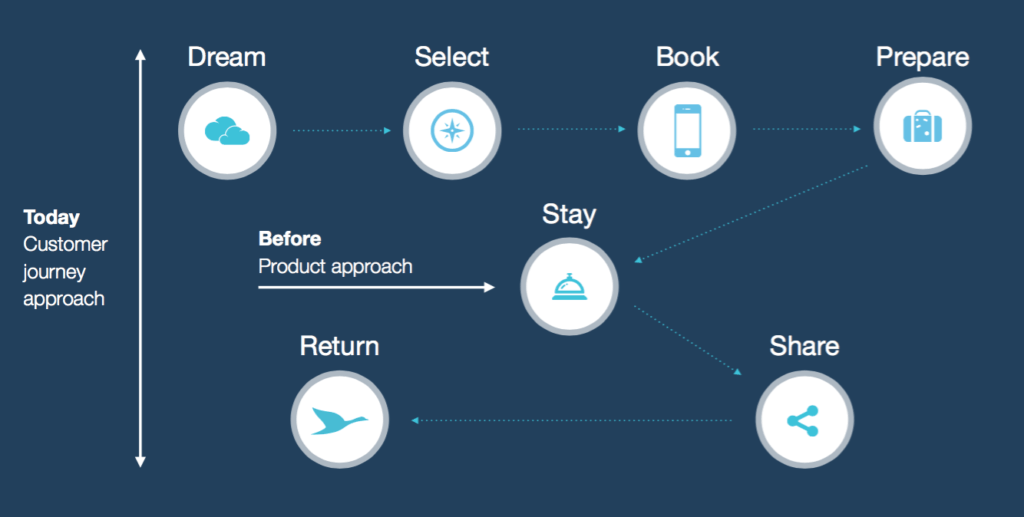

To better understand challenges and opportunities that digital technologies pose on Accor's business models and the hospitality industry, it is helpful to examine a customer journey (3).

From HBS Digital Initiative

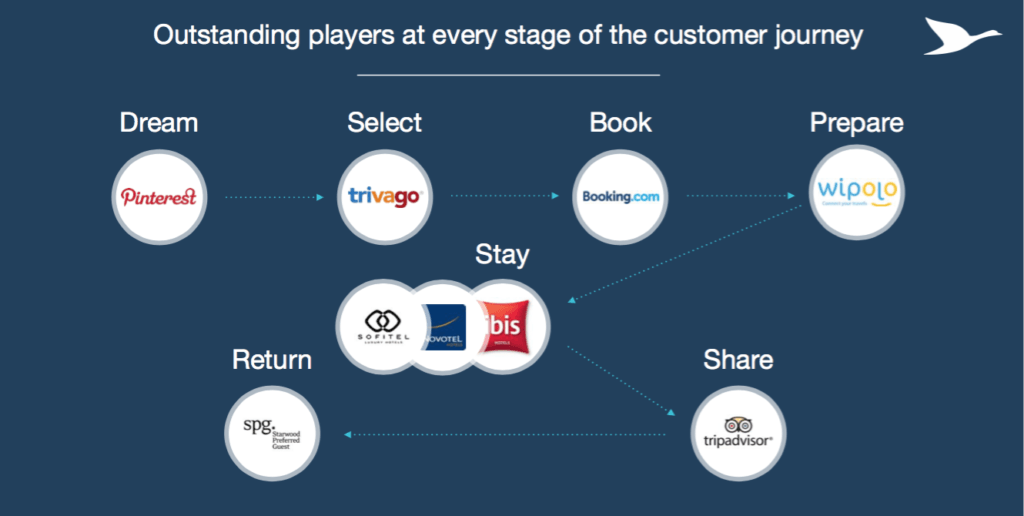

- Dream: Traditionally, customers relied mainly on tour operators and travel agents for information about hotel properties. Social media becomes a new channel in which guests can discover new destinations and hotels.

- Select: Digital revolution has reshaped the way customers select their hotels. Before adoption of internet, traditional hotel operators, such as Marriott, Hilton, and Accor, benefited from information asymmetry between customers and hotel properties. By leveraging years spent establishing brands' credibility and operational track records, these operators were able to attract customers to their hotels by delivering guests customer experience based on a brand's promise (4). The internet significantly improves the information flow among customers, hotel operators, and hotel properties, increasing transparency within the system whereby customers can easily obtain details, reviews, and pictures of hotel properties. Metasearch companies, such as Trivago, aggregate information on prices of hotels from different online travel agents and serve as price comparison platforms for consumers. It is estimated that 66% of travelers use different online sites to compare prices before making reservation (5). As a result of increased transparency, customers become less loyal to a hotel brand or a hotel company as they tend to select hotel that provides the best value.

- Book: Although online travel agents (OTAs) increase distribution and reach for hotel properties, they charge very high commissions as much as 15% to 28%, squeezing profit margins from hotel properties and hotel operators (6), (10).

- Prepare: New mobile applications allow hotel operators to combine digital technologies and human elements to enhance guest experience (7).

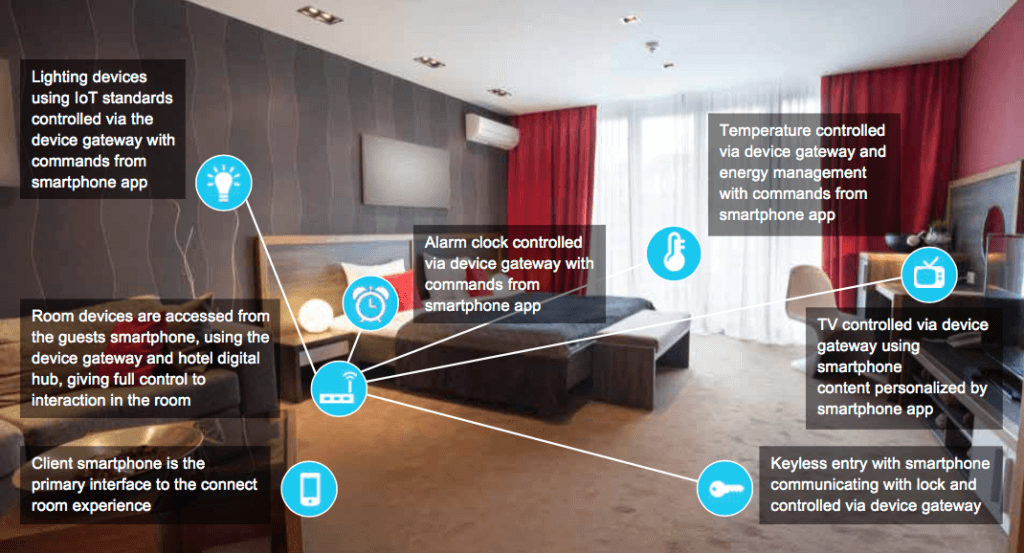

- Stay: Digital technologies provide opportunities for hotels to make customer experience more seamless, such as online check-in and cutting edge in-room technologies (5).

- Share & Return: Peer review sites, such as Tripadvisor, and social media allow guests to share their customer experience, increasing information flow between customers and hotel properties. These platforms provide hotels with data on customer satisfaction and allow hotels to respond to negative reviews to regain customer loyalty (3).

AccorHotels: Leading Digital Hospitality

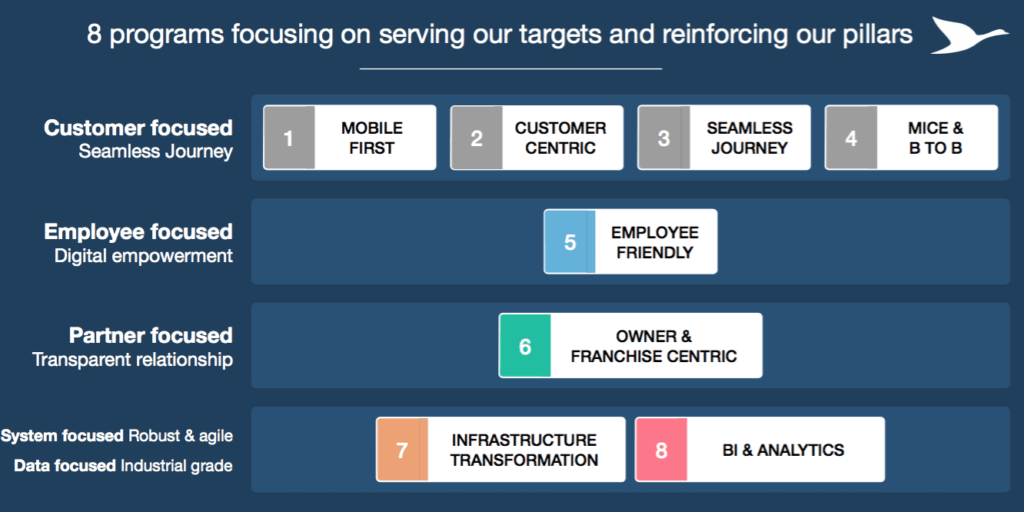

In 2014, Accor Hotels announced a five-year €225-million investment plan in digital strategy to reinvent customer experience. The plan has 3 targets (Exhibit 2):

- Customer: providing guests with seamless journey

- In 2014, Accor acquired a French-start up, Wipolo, to enhance its comprehensive mobile application and further with customer throughout the entire journey—before, during, and after guest's stay (2).

- Employee: use online platform to provide training and facilitate communications

- Owner and Franchise: use technology to provide dynamic pricing and revenue management strategies

Welcoming Independent Hotels

The biggest move was when Accor announced in 2015 that it will allow independent hotels to be listed on its website AccorHotels.com. Accor offers these hotels lower commissions than the rates demanded by Online Travel Agents, serving as a distribution channel in an effort to reduce OTAs' bargaining power and encouraging more direct bookings (8). The digital platform is facilitated by Accor's recent acquisition of Fastbooking, a European-based digital services provider for the hospitality industry (9). In addition, these independent hotels will also have access to Accor's loyalty program. While this move certainly provides travelers with more options (from 3,800 to 10,000 hotels) and benefits, it is questionable whether Accor's new digital platform can gain traction and justify the immense amount of investments.

Finding the right balance

As the effectiveness of AccorHotels.com depends on getting as many independent hotels to join, Accor should invest heavily in marketing this platform to attract independent hotels. In particular, it should focus on geographic regions, such as Europe and Asia, where there is a higher percentage of independent hotels in the markets. Nonetheless, in doing so, it is important that Accor continue to foster its relationships with major OTAs in parallel as these OTAs provide market exposure and attract first-time client to hotel properties.

Word count: 797

Source:

- Accor Hotels. http://www.hotelnewsnow.com/Articles/26387/Accor-brings-independents-into-distribution. Accessed 17 November 2016.

- Jill Avery, Chekitan S. Dev, Peter O' Connor. "Accor: Strengthening the Brand with Digital Marketing. Harvard Business School. 22 October 2015.

- Accor Hotels. Digital Technology presentation. http://www.accorhotels-group.com/fileadmin/user_upload/Contenus_Accor/Finance/PDF/2014/UK/20141030_accor_leading_digital_hospitality_presentation.pdf. Accessed 17 November 2016.

- "The Value of Brand promise." https://www2.deloitte.com/us/en/pages/consumer-business/articles/hotel-branding-promise.html. Accessed 17 November 2016.

- "Five big ideas to master digital in hospitality". https://www.accenture.com/us-en/insight-trends-travel-hospitality-digital. Accessed 17 November 2016.

- "Focus on Distribution: Hotels". http://www.travelmarketreport.com/articles/Focus-on-Distribution-Hotels-Value-Agents-But-OTAs-Rule. Accessed 17 November 2016.

- "Accor Hotels Acquires Mobile Developer Wipolo in Strategy Revamp". https://skift.com/2014/10/30/accor-hotels-acquires-mobile-developer-wipolo-in-strategy-revamp/. Accessed 17 November 2016.

- Accor Hotels. "AccorHotels accelerates its transformation". http://www.accorhotels-group.com/fileadmin/user_upload/Contenus_Accor/Finance/Pressreleases/2015/UK/accorhotels_pr_pdm_20150603_en.pdf. Accessed 17 November 2016

- "Accor accelerates its digital strategy by taking over FASTBOOKING". http://www.fastbooking.com/newsfeeds/accor-accelerates-digital-strategy-taking-fastbooking/. Accessed 17 November 2016.

- Hotel News Now. "Accor owners welcome independents". http://www.hotelnewsnow.com/Articles/26446/Accor-owners-welcome-independents. Accessed 17 November 2016.

- "AccorHotels CEO to the Hotel Industry: "You Have an Obligation to Be Bold"". https://skift.com/2016/08/05/accorhotels-ceo-to-the-hotel-industry-you-have-an-obligation-to-be-bold/. Accessed 17 November 2016.

留言

張貼留言